Regional Market Trends

RE/MAX brokers and agents nationwide, were asked to share a year-over-year analysis of their local market between January 1 and October 31 and share their estimated outlook for 2025. Ahead of 2025, it’s anticipated that 44 per cent regions will shift to a sellers' market (Victoria, BC, Greater Vancouver Area, BC, Edmonton, AB, Regina, SK, Sudbury, ON, North Bay, ON, Simcoe County, ON, York Region, ON, Windsor, ON, Thunder Bay, ON, Kenora, On, Fredericton, NB, Saint John, NB, Halifax, NS, Truro & Colchester, NS, and St. John’s Metro, N.L), while 33 per cent regions will shift to balance out (Vancouver Island, BC, Kelowna/Central Okanagan, BC, Winnipeg, MB, Kitchener-Waterloo, ON, Mississauga, ON, Brampton, ON, Durham, ON, Toronto, ON, Ottawa, ON, Sault Ste. Marie, ON, Kingston, ON, and Prince Edward Island), 17 per cent will shift to a buyers' market (Hamilton, ON, Burlington, ON, Peterborough, ON, Kawartha Lakes, ON, Muskoka, ON, and Haliburton, ON), while six per cent will experience mixed market conditions (Calgary, AB and Niagara, ON).

Based on their insights, the majority of the regions surveyed noted that first time homebuyers are one audience group driving the market across the nation, and many are looking for townhomes and small residential properties such as bungalows, while move-up and move-over homebuyers are looking for larger properties with additional space. On the flip side, retirees are seeking to down-size in most regions, with the exception of Calgary who are seeking villas and larger condominiums. Similar, to last year, many homebuyers are still looking for detached homes, as well semi-detached homes with income potential to off-set rising cost of living. These trends are likely to continue heading into 2025, according to RE/MAX brokers across the country.

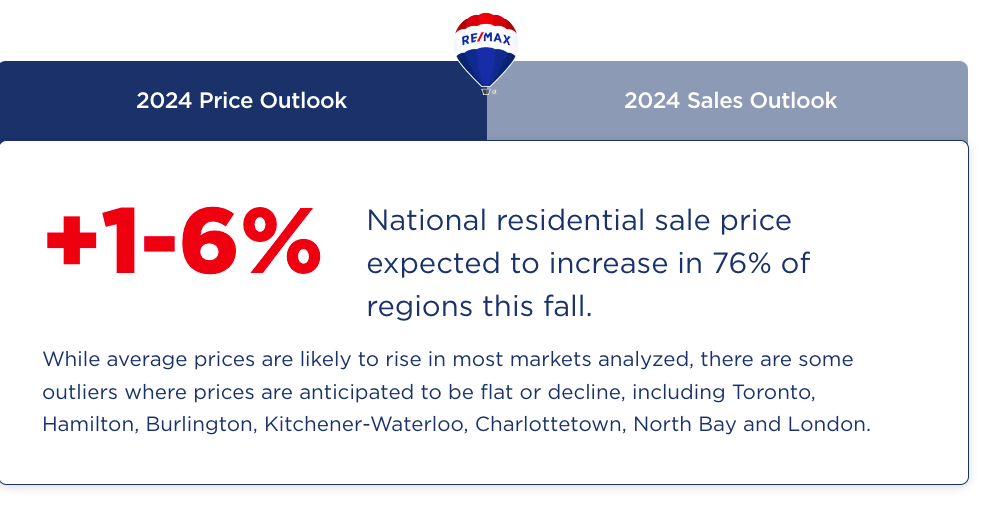

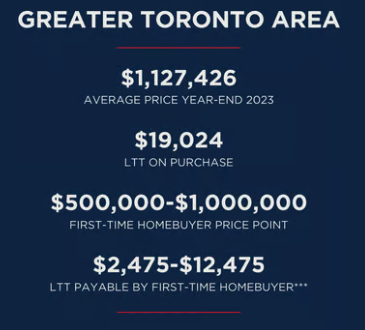

Toronto Housing Market Outlook

Move-up buyers and investors are expected to drive the bulk of sales activity in 2025, with single-detached houses being most in-demand in the region.

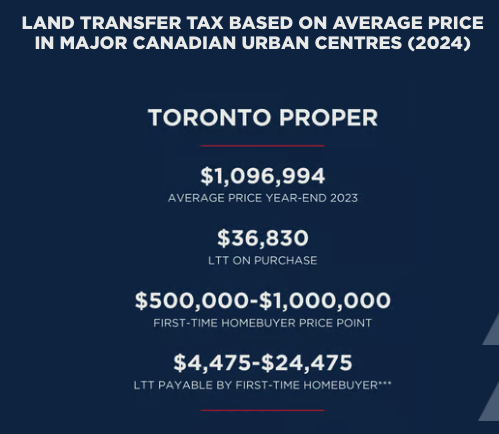

First-time homebuyers are typically buying condominiums and apartment units in the $450,000 – $750,000 price range. With the costs of homes in the city, first-time buyers are opting to enter the housing market through the condo market as they continue to save the larger down payments needed for other property types.

Move-up buyers are buying townhomes, semi-detached and detached homes in the $750,000 – $2,000,000 price range. Meanwhile, retirees are downsizing into condo apartments within the $1,000,000 – $2,000,000 price range, and the healthy supply of condos in the Toronto housing market right now provides a variety of options.

Planned new construction projects are being shelved, with many projects only proceeding if they have already been started.

Home sellers are feeling more confident heading into 2025 as homebuyers begin to re-enter the market. Reduced interest rates and prices, and loosening of mortgage regulations including the 30-year amortization announcement, will all make it easier for first-time homebuyers to purchase a home in Toronto as housing supply continues to increase.